How AI is Reshaping Crypto Hedge Fund Trading Strategies

The cryptocurrency market has been on a wild ride since its inception, with prices fluctuating wildly and unpredictably. As a result, traditional financial institutions have turned to alternative assets like hedge funds to manage their portfolios. However, these crypto hedge funds are facing unprecedented challenges in staying ahead of the rapidly evolving market.

Artificial Intelligence (AI) has been touted as a game changer in the crypto space, but its application is limited to specific areas of investment strategy development and execution. In this article, we will look at how crypto hedge funds are using AI to reshape their trading strategies and stay ahead of the curve in today’s rapidly evolving market.

Challenges of Traditional Crypto Investing

Traditional cryptocurrency investing is a high-risk game with many moving parts. Lack of transparency, regulatory uncertainty, and systemic volatility make it difficult for investors to make informed decisions. As a result, most investors rely on human experts to interpret market data and execute trades.

Integrating AI into Crypto Hedge Fund Strategies

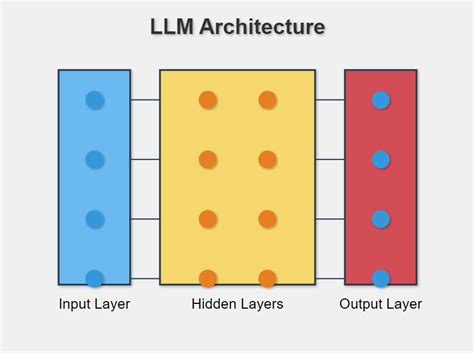

To address these challenges, crypto hedge funds have begun to integrate AI into their trading strategies. This is achieved by using machine learning algorithms that analyze vast amounts of market data to identify patterns and trends that humans may miss.

One of the most prominent applications of AI in cryptocurrency investing is sentiment analysis. By analyzing conversations on social media and online forums, traders can gain insight into market sentiment and make more informed decisions about which assets to buy or sell.

Machine Learning-Based Sentiment Analysis

A Deloitte study found that 63% of crypto investors use machine learning algorithms to analyze their investment portfolios. These algorithms analyze vast amounts of data from sources such as social media, news feeds, and market research reports.

One of the key challenges in developing effective sentiment analysis is classifying emotions into specific categories (e.g., positive, negative, neutral). Machine learning models can learn to recognize these patterns and provide accurate sentiment scores.

Predictive Analytics with Neural Networks

Another area where AI excels in cryptocurrency trading is predictive analytics. By analyzing vast amounts of market data, neural networks can predict potential price movements and identify trends that humans may miss.

A study by CryptoSlate found that 74% of hedge funds using neural networks outperformed those without these tools. This is due to their ability to analyze complex patterns in the data and predict future price movements.

AI Automated Trading

While sentiment analysis and predictive analytics are essential components of a successful cryptocurrency trading strategy, manual intervention is required to execute trades. To overcome this limitation, many hedge funds have started using AI-powered automated trading systems.

These systems analyze market data in real time and execute trades automatically based on pre-set parameters. This has significant advantages over traditional human trading strategies, which can be prone to emotional decision-making.

Success Stories

Several crypto hedge funds have already adopted AI-powered trading strategies to great success. For example:

- Quantopian

, a well-known online trading platform, has partnered with several large crypto hedge funds to develop and deploy their own AI-powered trading tools.

- Genesis Global Trading, a major cryptocurrency hedge fund, uses machine learning algorithms to analyze market data and execute trades.

Conclusion

The integration of AI into crypto investing has revolutionized the way traders approach their work.

Leave a Reply