Here is a comprehensive article on cryptocurrency, open interest, token sales and ROI:

“Betting big: understand crypto, open interest, token sales and return on investment (ROI)”

The world of cryptocurrency has conquered the financial markets in the storm in recent years, with thousands of investors bet on their potential. However, before it invests in this volatile space, it is important to understand the basics of each component that contributes to the value of a cryptocurrency.

Open interest: What is open interest?

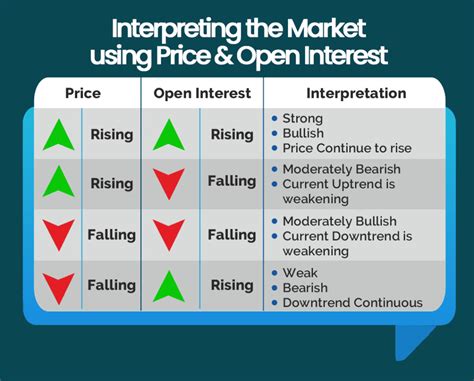

Open Interest (OI) refers to the total number of outstanding shares in a certain security, which are not yet concluded by buying or sales orders. In other words, it measures the measure of market interest in certain security, including buyers and sellers. If open interest is high, this indicates a strong demand for security, as there are many more potential buyers than sellers. If the open interest is reversed, it indicates that the market may be oversized or undervalued.

Token Sales: What is a token sale?

A token sale is an event at which a cryptocurrency project collects donations by selling its local cryptocurrency (token) to investors. This can happen with different means such as crowdales, initial coin offers (ICOS) and private placements. The main purpose of a token sale is to procure capital for the development, marketing or operating costs of the project.

Return on Investment (ROI): What is ROI?

Roi refers to the return or the profit, which is achieved by an investment over a certain period of time, which is normally expressed as a percentage. In the context of cryptocurrency investments, Roi measures how much money you have earned with your initial investment regarding the costs that you have incurred for the purchase.

When evaluating a token sales and the potential ROI, investors must take several factors into account, including:

* TOKEN Prize : The current market value of the token is crucial for determining the potential ROI.

* Market demand : A strong buyer base can increase prices and possibly increase the ROI.

* Development team

: A well -financed and experienced development team can lead to a faster project acceptance and a higher ROI.

* Competition : Different tokens can compete from each other or from established projects that can affect their ROI.

How do you calculate roi

To calculate the ROI of a token sales, you must separate your initial investment by the price you paid for it. For example:

First investment: 1,000 US dollars

TOKEN price: $ 10

Roi = ($ 1,000 ÷ 10 USD) x 100% = 10%

This simple calculation shows how investors can compare their ROI via various token sales.

Real-life example

Let us assume a new cryptocurrency project called “Ecocycle” starts a token sale to collect donations for the development team and marketing efforts. The project has open interest rates of 1 million US dollars with a current price of USD 5 per token. If you invest 10,000 US dollars in the first round of financing, your Return on Investment (ROI) would be:

First investment: 10,000 US dollars

TOKEN price: $ 5

Total costs: 10,000 US dollars

Roi = (10,000 USD ÷ 5 USD) x 100% = 200%

Diploma

Cryptocurrency investments can be a high risk of high reward. By understanding the concepts of open interest, token sales and ROI, investors can make more informed decisions about their investments. Remember to carry out always thorough research, to determine realistic expectations and diversify your portfolio to minimize the risk.

Regardless of whether you are an experienced investor or just start, it is important to stay up to date with the latest news and developments in the world of cryptocurrency. With a solid understanding of these basics, you will be better equipped to control the complex and constantly changing landscape of crypto investments.

Leave a Reply