Mastering Crypto Risk Management: A Guide to Securing Your Digital Portfolio

The world of cryptocurrencies has exploded in recent years, with millions of individuals and institutions investing their hard-earned money in digital currencies such as Bitcoin, Ethereum, and others. While the potential for high returns is tempting, it is important to acknowledge that the cryptocurrency market comes with inherent risks. A crucial aspect of navigating this complex space is risk management.

What is Crypto Risk Management?

Risk management in the context of cryptocurrencies involves assessing and mitigating potential losses before they occur. It requires a deep understanding of the underlying factors that can affect the value of your investments, such as market fluctuations, regulatory changes, and security breaches. By employing effective risk management strategies, you can reduce your exposure to market volatility and protect your digital assets.

Cross-platform trading: A key component of risk management

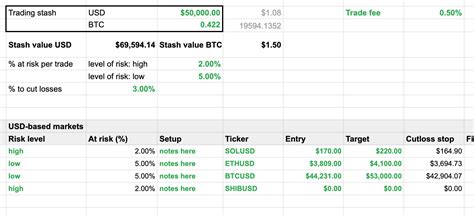

When trading cryptocurrencies on multiple platforms at the same time, you need to consider the risks involved. Cross-platform trading involves executing trades across different exchanges, wallets, or brokers. To mitigate these risks, traders often employ strategies such as the following:

- Diversification: Spreading investments across different exchanges and assets to reduce reliance on a single platform.

- Stop-loss orders: Setting price targets when a trade reaches a certain level, which triggers an automatic sell order to limit losses.

- Risk-reward ratios: Setting strict risk-reward ratios for your trades to ensure you only risk what is necessary to achieve your desired return.

Wallet Seed Phrase: A Secure and Confidential Key

A wallet seed phrase is a series of random numbers and words used to create and manage digital wallets, such as those found on cryptocurrency exchanges. Although this term may seem to have nothing to do with risk management at first glance, it plays a crucial role in securing your investments. Here’s why:

- Security

: A seed phrase is a highly sensitive piece of information that can only be shared with authorized parties, ensuring that your wallet and assets remain confidential.

- Consent: When you create a new wallet or access an existing one, you give the exchange or platform permission to use the seed phrase. This level of consent is essential to maintaining control over your digital assets.

- Auditability: A wallet’s seed phrase can be used as proof of ownership in the event of a breach or security incident.

Best Practices for Managing Your Crypto Portfolio

To successfully navigate the complex world of cryptocurrencies, consider the following best practices:

- Educate yourself: Continually educate yourself on the risks and opportunities associated with each asset and market.

- Set clear goals: Define your investment goals and risk tolerance before you start investing in cryptocurrencies.

- Diversify your portfolio: Spread your investments across different assets, exchanges, and brokers to minimize exposure to a single platform or market.

- Use reputable exchanges and platforms: Research and choose established exchanges with robust security measures and user-friendly interfaces.

- Monitor your accounts regularly: Regularly review your trading activity, account balances, and transaction history to identify potential risks and opportunities.

Conclusion

Mastering crypto risk management is a crucial step in navigating the rapidly evolving world of digital currencies. By understanding the complexities of cross-platform trading, wallet seed phrases, and security measures as highlighted in this article, you can take control of your investments and protect your assets from market volatility.

Leave a Reply