The importance of risk assessment with SEI and commercial competitions in the cryptocurrency market

In recent years, the world of cryptocurrency has increased exponentially and millions of investors worldwide have been gathering to mention digital assets such as Bitcoin, Ethereum and others. Although this market can be exciting, it also has a set of risk. One of the key aspects of navigation in this high-risk environment is the risk assessment-a basic process that helps investors make informed decisions about their investments.

What is risk assessment?

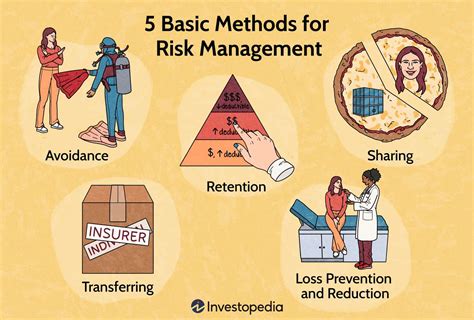

Risk assessment is a systematic assessment of potential losses or profits related to the investment decision. It includes an analysis of various factors, such as market trends, investor sentiment and security gaps, to determine the likelihood of a success of a particular investment strategy. In the cryptocurrency market, risk assessment is particularly important due to the inherent variability and unpredictability of these assets.

The role of SEI (Investor Institutional Institutional Education Society)

SEI is an organization that provides educational resources and services to support institutional investors in the United States. One of their key initiatives is to help investors evaluate the risk of cryptocurrency investment. When conducting research, analyzing market trends and the development of instruments to facilitate risk assessment, SEI aims to train and allow institutional investors to make informed investment decisions.

Benefits of Risk Assessment using SEI

Risk assessment can be a breakthrough for cryptocurrency investors who want to maximize their phrases while minimizing their losses. Following the SEI approach, investors can:

- Understand the market trends : SEI risk analysis tools provide investors with an idea of market sentiment, trade volume and other key indicators that help them make conscious decisions.

2.

3

- Improving investment efficiency : By accepting a proactive risk assessment approach, investors can optimize their investment strategies to maximize the return on minimization of losses.

Commercial competitions: Key element of risk assessment

In addition to risk assessment, commercial competitions play an important role in the cryptocurrency market. These events are a platform for experienced traders and investors to test their skills against other participants, supporting the culture of competition and innovation.

Trade competitions can help investors:

- Skills Development : Competition allows participants to improve their commercial skills and learn from others, helping them to improve their results and reduce risk.

2.

3

App

In summary, risk assessment is a key element of moving around the high environment in the cryptocurrency market.

Leave a Reply