diversification of the portfolio: how to manage cryptocurrency risks

The world of cryptocurrency has recorded a huge growth in recent years, with many investors and traders who have taken advantage of the potential for the high returns. However, this rapid increase in value can also lead to risks that must be carefully managed. In this article, we will explore the concept of diversification of the portfolio and provide suggestions on how to manage cryptocurrency risks.

** What is the diversification of the wallet?

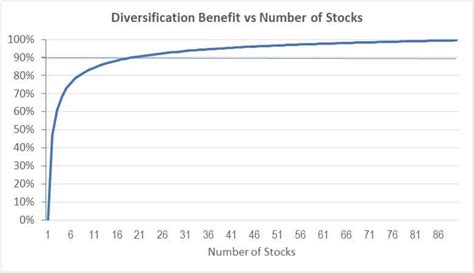

The diversification of the portfolio is a financial strategy that involves the spread of investments in different classes of activities, industries or sectors to minimize risk and maximize potential returns. In this way, investors can reduce their exposure to any individual investment and increase the stability of the overall portfolio.

In the context of the cryptocurrency, diversifying your portfolio means having a mix of different cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and others, distributed in classes of activities such as cash, actions, bonds or other alternative investments . This helps to mitigate the risks associated with each individual investment, ensuring that your portfolio remains stable even in the event of a recession market.

Risks associated with cryptocurrency investment

Before immersing ourselves in diversification strategies, it is essential to recognize some of the main risks involved in the cryptocurrency investment:

- Price volatility : cryptocurrencies are known for their high -price oscillations, which can lead to significant losses if not correctly managed.

- Risk of liquidity : Some cryptocurrencies may have the will of limited trading or be difficult to sell quickly, leading to potential losses.

- Safety risks : exchanges and wallets that discuss cryptocurrencies can be vulnerable to hacking or theft, with consequent loss of funds.

- Regulatory risks : changes in the regulatory environment can affect the value and usability of some cryptocurrencies.

Diversification of the cryptocurrency portfolio

To manage these risks, it is essential for several wallets by spreading investments in different classes of activities and cryptocurrencies. Here are some suggestions:

- Average costs from one dollar : invest a fixed amount of money at regular intervals, regardless of market conditions.

- Distributed in different cryptocurrencies : allocate your investment on multiple cryptocurrencies to minimize risk.

- Invested in Stablecoins

: Stablecoins such as USDT (Tether) or USD Coin (USDC) are anchored to the value of Fiat currencies and offer a low risk option.

- CONCEANT CONDENT AND OTHER ACTIVITIES : maintain some reserves in cash and hold other alternative investments, such as actions or bonds, for a potential long -term growth.

5

Best Practice for the management of the cryptocurrency portfolio

- conducting in -depth research : before investing in any cryptocurrency, conduct in -depth market research and consider multiple sources of information.

- Set up in investment objectives : define investment objectives, risk tolerance and time horizon before selecting cryptocurrencies.

- Use a solid investment strategy

: develop a well -weighted investment plan that aligns with your goals and risk tolerance.

- Review and adapt regularly : periodically review your portfolio to make sure that it remains aligned with the investment objectives and adapt if necessary.

Conclusion

The diversification of the portfolio is an essential aspect of the management of cryptocurrency risks. Difference investments in different classes of activities, cryptocurrencies and other alternative investments, it is possible to mitigate some of the potential risks associated with investments in cryptocurrency.

Leave a Reply