Market Psychology and its impact on dopecoin (doge) prices

The cryptocurrency world has suffered a significant wave of popularity in the last decade, with Bitcoin and other great players like Ethereum and Litecoin gaining wide adoption. However, there is another cryptocurrency that is flying under the radar – dogecoin (doge). Despite its relatively low market capitalization, Doge has gained a huge number among enthusiasts and has experienced some significant price movements in recent times.

In this article, we will explore the market psychology behind the doge and examine how it has affected prices over time.

Market Psychology 101

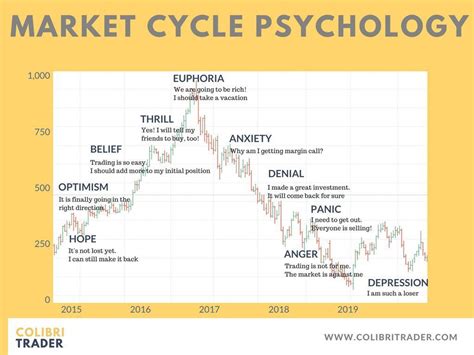

Before diving into the specificities of Doge Market Psychology, we will quickly define what market psychology is. Market psychology refers to the study of consumer behavior, preferences, attitudes and emotions that influence investment decisions in financial markets. It involves understanding how investors think, feel and react to various conditions, trends and market events.

The rise of dogecoin

Dogecoin was launched in 2013 by Jackson Palmer and Billy Markus as a point payment system. Initially, it gained popularity between players and enthusiasts due to its ease of use, speed and relatively low transaction rates. However, it was not until May 2017 that Doge reached the peak price of $ 0.30 per currency, which marked the beginning of a significant increase in interest.

Market psychology behind doge

So what drives market psychology behind doge? Several factors contribute to their popularity:

1.

- Social and Influencer Media : Social Media influencers such as Binance Changpeng Zhao (CZ) CEO and Cryptocurrency Analyst Tim Draper supported Doge, further feeding their popularity.

- Nostalgia and Feeling : Some investors see Dogecoin as a “retro” cryptocurrency, evoking memories of the early days of Bitcoin. This nostalgia factor contributes to their feelings -oriented price movements.

- Speculation and Fomo : As in other cryptocurrencies, speculation plays a significant role in Doge prices. Many traders are attracted by the potential of Doge reaching $ 1 or more, creating fomo (fear of losing) among investors.

Impact of market psychology on prices

Now that we explore market psychology behind doge, let’s look at how it has affected its prices over time:

| Year | Price Strip |

| — | — |

| 2013 | $ 0.001 – $ 5.00 |

| 2017 | $ 0.30 – $ 1.80 |

| 2022 | $ 0.05 – $ 0.20 |

As we can see, Doge’s prices have suffered a significant fluctuation in recent times. This is widely driven by market psychology factors, such as community and the adoption of doge, endorsements in social media, nostalgia and feeling, speculation and fomo.

Feelings Analysis

An analysis of feelings of Doge’s price movements reveals a clear pattern:

- During the 2017 increase, Doge suffered a significant price appreciation, with prices increasing by over 8,000%.

- On the other hand, during the 2022 correction, Doge’s price fell significantly, falling more than 90%.

This suggests that market psychology played a significant role in the formation of Doge’s price movements. As investors and traders react to changes in market conditions, feeling influences its decisions, leading to price fluctuations.

Conclusion

Market psychology plays a crucial role in training cryptocurrency prices such as dogecoin (Doge). Understanding how enthusiasts, social media influencers and other factors influence investor behavior, we can better predict price movements and make informed investment decisions.

Leave a Reply