The future of decentralized exchanges: innovations and trends

In the world of finance, blockchain technology has revolutionized our way of thinking about money. An area that has been particularly exciting to explore is decentralized exchanges (DEX). These platforms have become a must in the cryptocurrency market, offering a range of innovative features and trends that are ready to shape the future of digital trading.

What are decentralized exchanges?

A decentralized exchange is an online platform where users can buy, sell or exchange cryptocurrencies without relying on traditional intermediaries such as banks or brokerage houses. Dex use Blockchain technology to allow peers transactions, allowing users to exchange assets directly with each other without the need for a centralized exchange.

Innovations in decentralized exchanges

- Automated market manufacturers (AMMS) : AMMs are a type of decentralized exchange that uses automated merchants to provide liquidity and maintain fair prices. This technology has rationalized trading processes, reducing congestion and improving overall efficiency.

- Decentralized financing integration (DEFI) : DEFI platforms have integrated into DEX, allowing users to access a wide range of loan, loan and performance agricultural services. This integration should increase the adoption of decentralized finances within the cryptocurrency ecosystem.

- Tokenization : Tokenization allows users to create their own tokens on a blockchain network. This has opened up new opportunities for innovative financial applications, such as digital real estate and social media platforms.

- Decentralized identity verification (DID) : DID allows users to safely check their identity by a large decentralized book, ensuring the integrity of transactions and preventing potential fraud.

Trends of decentralized exchanges

- Increased adoption : Dex have become more and more popular among institutional investors and individual traders, many platforms experiencing rapid growth.

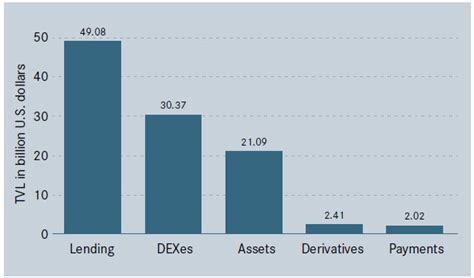

- RISE OF DEFI : The DEFI space has experienced a significant traction, driven by the proliferation of loans, loans and agriculture services on decentralized exchanges.

- Expansion in new markets : Dex are used in various industries beyond cryptocurrency, including sports betting, entertainment and even traditional financing applications such as credit card transactions .

- growing importance of safety

: The growing importance of security has led to the development of more robust portfolio solutions and anti-malware protection for users.

Examples of the real world of successful Dexs

- Uniswap : A prominent Dex which offers a range of trading pairs, including perpetual swaps.

- CURVE Finance : A popular challenge platform that offers agricultural opportunities on its decentralized exchange.

- Balance Protocol : A decentralized exchange that allows users to create and exchange their own tokens.

Challenges and limitations

- Regulatory uncertainty : The regulatory landscape of DEX is always evolving, which makes it difficult for platforms to operate in a stable environment.

- Security risks : As with any online platform, security risks exist, including hacking, phishing and other cyber managers.

- Evolution : current decentralized exchanges can be slow and congestioned, which limits the capacity to treat high volumes of transactions.

Conclusion

Decentralized exchanges have transformed the way we think of negotiations into cryptocurrency. With innovations such as automated market manufacturers, DEFI integration, tokenization and DOD, DEX are ready to play an important role in training the future of digital trading. Although there are challenges, the potential advantages of decentralized exchanges make it an exciting field of exploration for investors and merchants.

Leave a Reply