The final guide to the MacD in the cryptocurrency trade

Cryptocurrencies are a hot topic in the world of exchanges for several years. With the ascent of cryptocurrencies such as Bitcoin, Ethereum and others, the traders are looking for new ways to analyze and create profitable operations. One of the most popular technical analysis tools used in the cryptocurrency trade is the divergence of average mobile convergence (Macd), which has been widely adopted by traders by all levels. In this article, we will provide a complete guide on the MacD, including its components, settings and how to use it for cryptocurrency trading.

What is Macd?

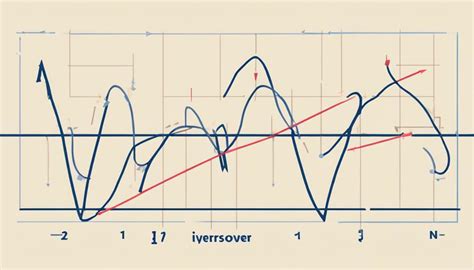

The MacD stands for the divergence of average mobile convergence, which is a technical analysis tool that helps traders to identify trends in financial markets. The MacD is a lines graph that traces two mobile averages of different periods of time. A line is the exponential moving average at 12 periods (EMA) and the other is the EMA at 26 periods. When these two lines converge or diverge, it can indicate the strength and direction of a trend.

components of macd

The components of the MacD are:

- Signal line : This line traces above EMA to indicate potential purchase signals.

- Foiled line : This line plot under EMA to indicate potential sales signals.

- Crossover indicator : When the signal line crosses above or under the maintenance line, it indicates a modification of the trend.

Settings

Macd setting:

- EMA periods: Choose 12, 26 or any other number of periods you prefer. The longer the Ema period, the more stable it will be.

- Period of the signal line : this determines the frequency with which the signal line crosses above or under the maintenance line to indicate a modification of the trend.

How to use MacD for cryptocurrency trading

Use of MacD in cryptocurrency trading:

- Short -term trading : USA MacD on shorter times such as 1 hour, 4 hours and 8 hours graphs.

- Long -term trading : Use MacDs on longer times as daily, weekly or monthly graphic graphics.

- Identifies the trends : look for the crossover between the signal line and the retained line to identify potential trend changes.

- Confirm signals : use other indicators such as RSI, Bollinger bands or stochastic oscillator with MacD to confirm purchases or sale of signals.

Tips and tricks

- Start with a Forte Foundation: before using Macd in cryptocurrency trading, make sure you have a solid understanding of the concepts of technical analysis.

- Use more times : Try several MacD settings on different times to see what works best for your trading style.

- Be patient : Macd is not a magical tool that will guarantee profits; It is essential to be patient and consistent with your trading strategy.

- Do not attract : avoid overwhelming using Macd only when you have a strong belief on the trend.

Conclusion

MacD is an advanced technical analysis tool that can help traders identify trends and do profitable operations in the cryptocurrency markets. Following this complete guide, you will be on the way to master the MacD technique and become a successful cryptocurrency trader. Remember to remain patient, disciplined and informed, since the world of cryptocurrency trade is constantly evolving.

Additional resources

For more information on MacD and technical analysis, it is recommended to check the following resources:

* Investiopedia : a complete resource to learn financial markets and technical analysis.

* Tradingview : a platform for the graphic designer and analysis of financial markets, with a large community of traders and analysts who share knowledge and insights.

* Cryptocompare : a website that provides cryptocurrency prices in real time, graphs and news.

Leave a Reply